Month:

Commercial Mortgage

No Income Verification Commercial Loan Investment SFR, Condo & 2-4 Units Multi-Family, Mixed-Use, Office, Retail, Warehouse, Self-Storage, Auto Service Flexible Guidelines Nationwide Direct Portfolio Lender Up to 75% LTV Simple Doc Origination + Rebate OK Standard 30yr Term Loan

Refinancing

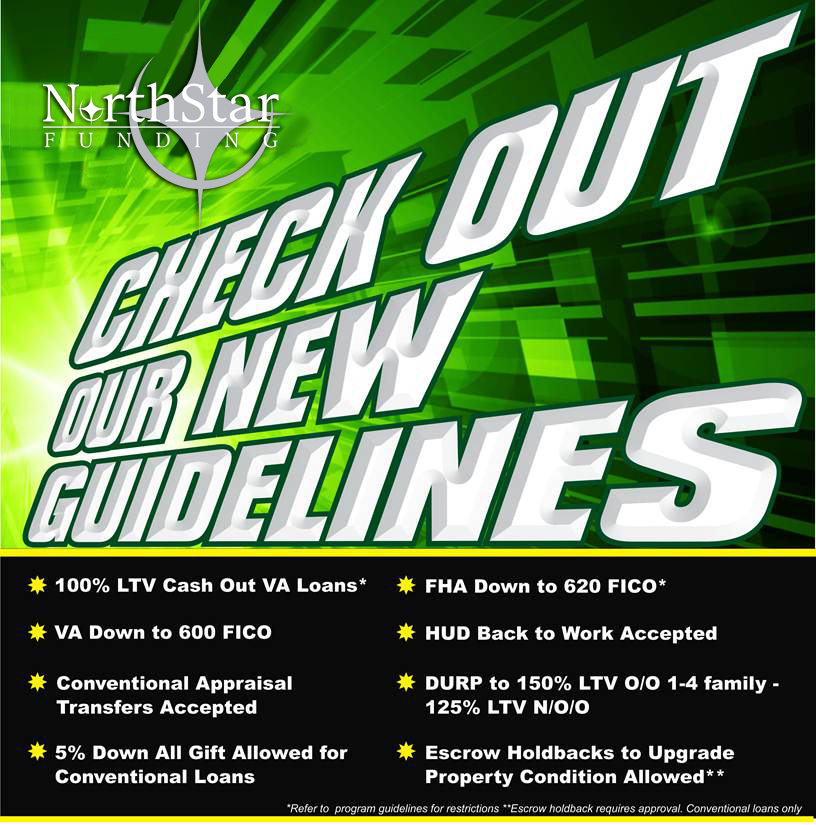

Refinance Home Loan in Hoboken, NJ – Serving New York – Manhattan, New Jersey, California, Connecticut & Florida Struggling with your bills in Hoboken, NJ? Refinance home loan options may be able to help you get yourself on track to a brighter and more stable future. Here at Northstar Funding, we have mor

Residential Mortgage Loans

Home Mortgage Loan in Hoboken, New Jersey – Serving New York – Manhattan, New Jersey, California, Connecticut, & Florida For many, owning a home is a lifelong dream. Whether you're a first-time buyer or are looking to upgrade to a larger space in Hoboken, NJ, let NorthStar Funding turn your vision of

Conventional 97% Financing

Home Ready Not required to be a first time home buyerIncome Limits: 80% of AMI most areas. Higher percentages avaialble for high minoritycensus tracks or homes in disaster areasMI Coverage: 25% MI coverage for LTV ratios 90.1 - 97%. Standard MI for 90% or lower.Pre-Purchase homeownership education requiredPur

FHA Streamlines

FHA Streamline is the simplest and easiest way to refinance an FHA loan. Unlike a traditional refinance an FHA Streamline Refinance allows a borrower to refinance without having to verify their income and assets. An appraisal might not be required either depending on how much you have paid on your original loan b

203k FHA Construction Loans

FHA Standard 203(k) Loan Northstar Home Funding offers even more options for borrowers to finance home repairs right at closing. The FHA Standard 203(k) program offers additional home repair options not offered in the Limited version, including: Room additions Second floor addition Structural repairs Fou

Work Visa. ExPat Program

Who Qualifies for this Loan Program? Foreign Nationals with current Work Visa or job offer letter that will provide a Work Visa Moving to U.S. for employment or living in U.S. as W2 wage earner No U.S. credit score or low score due to lack of history is acceptable Green Card Holders No U.S. credit

Investment Coop

Securing a mortgage loans for an investment co-op can be challenging. NorthStar Funding has the resources to assist you. Amortization Type: 5/1 Adjustable 30 Year Fixed Rate Minimum FICO: 620 Maximum DTI: 43% Eligible Transactions: Purchase Rate & Term (Limited Cash-out) Refinance Cash-out Refina

Flex Foreign National Loan

Northstar Funding can broker a wide variety of loans to non-permanent residents. We can help broker products, for single family homes, 2-4 unit properties, warrantable and non-warrantable condos, condotels and more. These loans feature: Maximum LTV of 70%Foreign/No Credit acceptableMaximum loan of

FHA 203k Loans for Construction Loans

Commercial Construction Loans FHA 203k This program is designed to provide a business loan to a Builder constructing a commercial property (Office Buildings, Retail Stores, Shopping Centers, Warehouse/Flex Space, 5+ Multi-Family units and most other income generating properties). Fast pre-qualification,

Buying After Short Sale

If you are looking to buy a home again after you sold your home through a short sale, we can help you. There are loan programs designed for borrowers with a credit event that may preclude qualification for another program. Such events include, without limitation, unseasoned bankruptcy, recent foreclosure, short s

Affordable Alternatives to FHA Loans

When a home buyer has limited funds for a down-payment, the first thing many lenders will offer is an FHA loan. That's a terrific option...sometimes. NorthStar Home Funding has been in business long enough to know that not every low-down-payment buyer should be lumped into an FHA loan. The cost of FHA mortgage